About the Mentor:

Mr Keshav Arora is a Second generation Professional aggressive Trader focusing majorly on derivatives Options of Indices like NIFTY, BANK NIFTY and STOCKS, With a capital of 2 Crores and has been consistently compounding his capital for past 5 years at a rate of more than 20-30 percent per annum. He is one of the Top one percent trader who knows to convert his losses to profit for the Exit of any strategy.

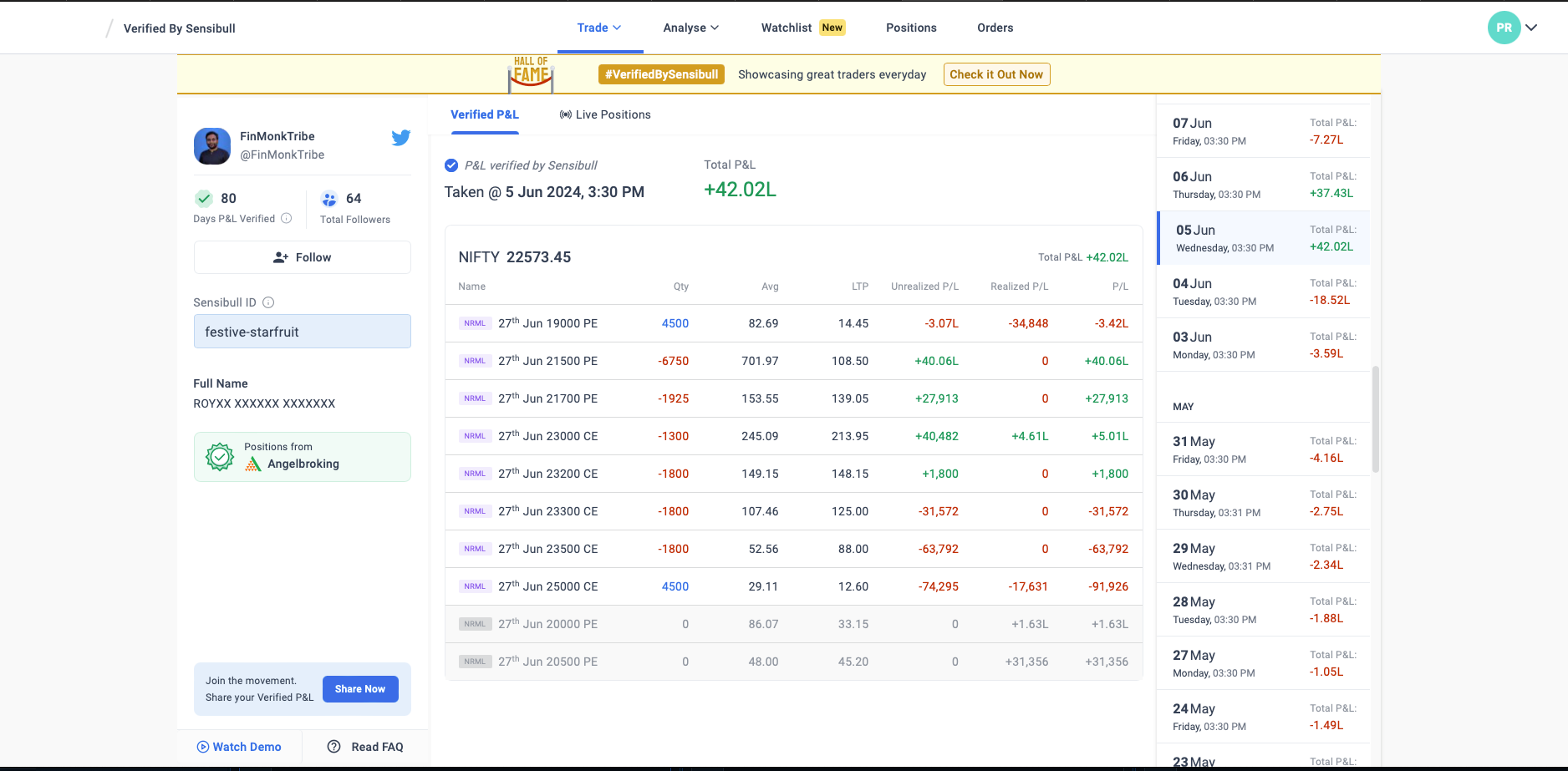

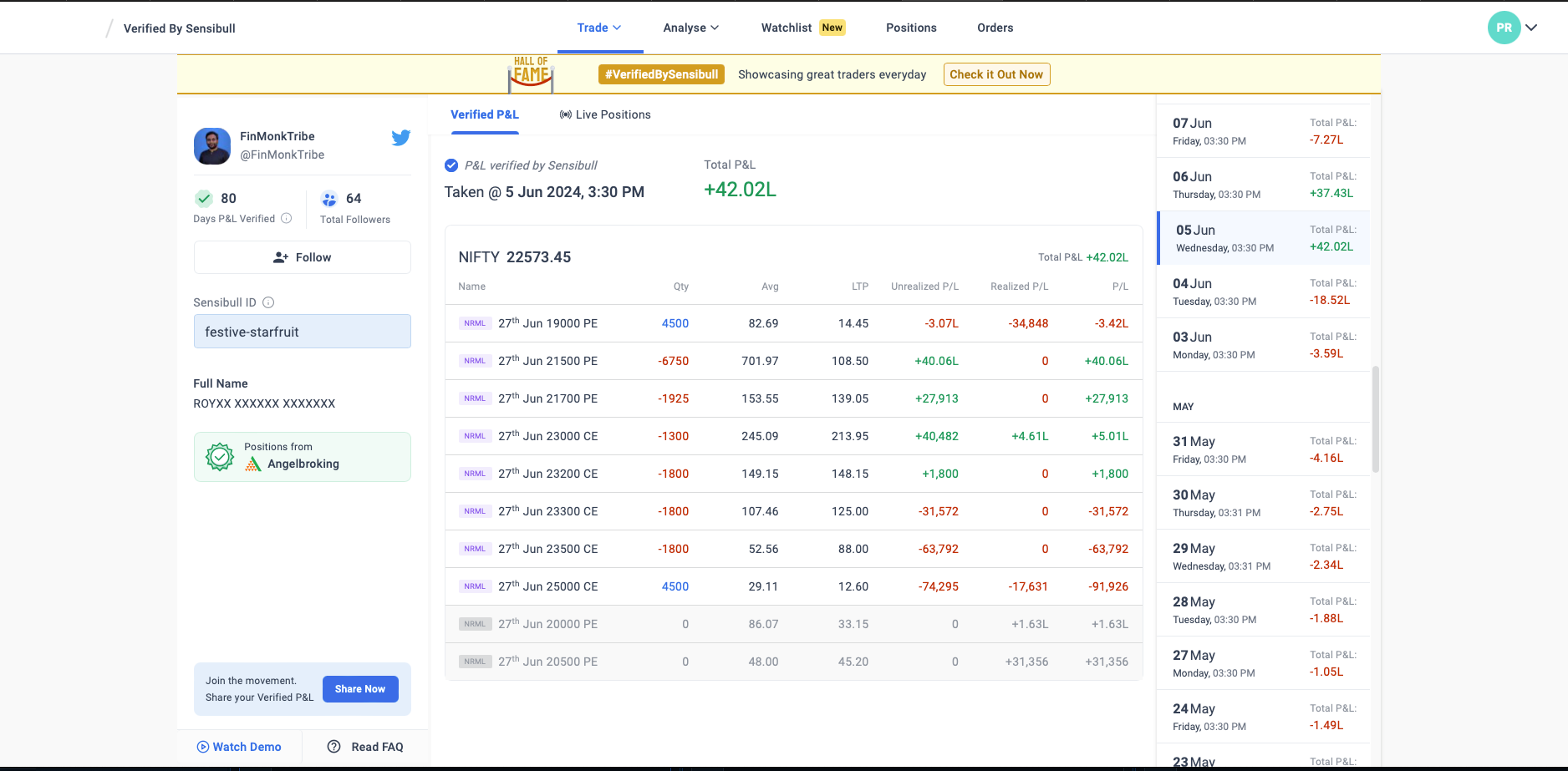

YOu can check his Track Record using VERIFIED BY SENISULL link Below and chec k the image for his profits he generated during the Election TRADE.

LINK: https://web.sensibull.com/verified-pnl/festive-starfruit/cJBLzWmPDGkMeU

Course Description :

Module 1: Introduction to Options Trading

- Basics of Options: Definitions and terminology (calls, puts, strike price, expiration).

- Types of Options expiry: Taking Trade based on weekly and monthly options in INDICES and Equity

Module 2: Understanding Options Pricing

- Intrinsic Value and Time Value: Components of option prices.

- The Greeks: Delta, Gamma, Theta, Vega, Rho.

- Implied Volatility: Concept and significance.

Module 3: Options Strategies for Hedging and scalping

- Protective Puts: Hedging against downside risk.

- Covered Calls: Generating income and partial hedging.

- Spreads: Combining puts and calls with hedging.

- Straddles and Strangles: Hedging against volatility.

Module 4: Advanced Hedging Techniques

- Delta Hedging: Maintaining a delta-neutral portfolio.

- Portfolio Insurance: Dynamic hedging strategies.

Module 5: Developing and Backtesting Hedging Strategies

- Strategy Development: Identifying objectives and designing strategies.

- Backtesting Techniques: Historical data analysis and simulation.

- Performance Measurement: Evaluating the effectiveness of hedging strategies.

Module 6: Delta and Gamma Hedging

- Delta Hedging: Maintaining a delta-neutral position.

- Gamma Hedging: Managing the non-linear risk.

- Dynamic Hedging: Adjusting hedges as market conditions change.

Module 7: Practical Applications and Case Studies

- Hedging with Index Options: Strategies specific to Nifty and BankNifty options.

- Sector-Specific Hedging: Using BankNifty for sector exposure management.

- Real-World Case Studies: Historical examples and practical exercises.

Module 8: Risk Management and Portfolio Hedging

- Risk Management Frameworks: Setting up and monitoring hedging strategies.

- Portfolio Hedging: Using Nifty and BankNifty for broader portfolio protection.

- Stress Testing and Scenario Analysis: Evaluating strategy performance under various market conditions.

Module 9: Technology and Tools for Hedging

- Trading Platforms: Overview of popular platforms for trading Nifty and BankNifty futures and options.

- Analytical Tools: Using software for options analysis and Greeks calculation.

- Automated Hedging Strategies: Introduction to algorithmic hedging

Module 10: LIVE Trade example with Actual Cash portfolio and training for mentees

After successful purchase, this item would be added to your courses.

You can access your courses in the following ways :

- From Computer, you can access your courses after successful login

- For other devices, you can access your library using this web app through browser of your device.